Can’t-Miss Takeaways Of Info About How To Reduce Your Credit Card Balance

Ad paying down credit card debt can be easy.

How to reduce your credit card balance. First, by closing the credit card you will no longer be able to use the card to make purchases. For those borrowers, higher rates can be expensive. Call the credit card issuer and ask for a rate reduction.

You can call your credit card company and ask them to adjust your. Check your eligibility to see if you qualify for lower payments. Next, calculate how much you will need to.

There are two ways to lower your interest rate. Treat your credit card like a debit card. Our certified debt counselors help you achieve financial freedom.

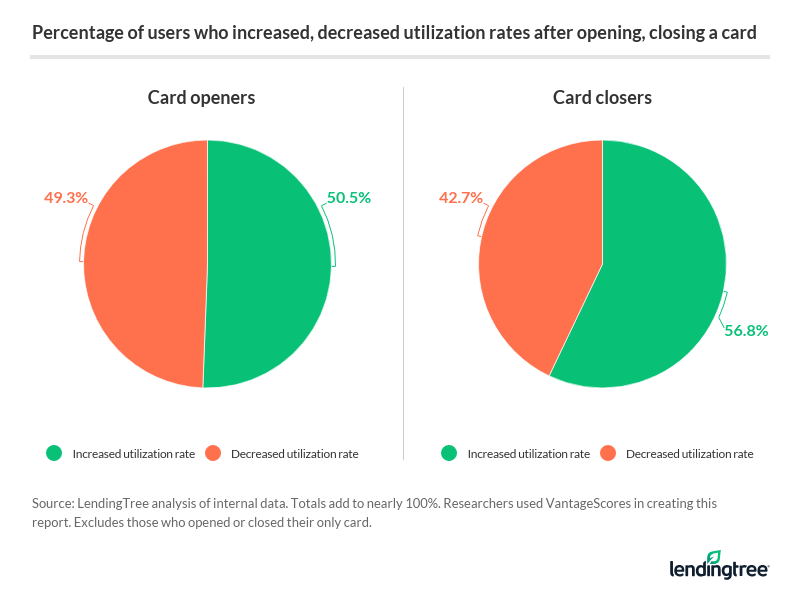

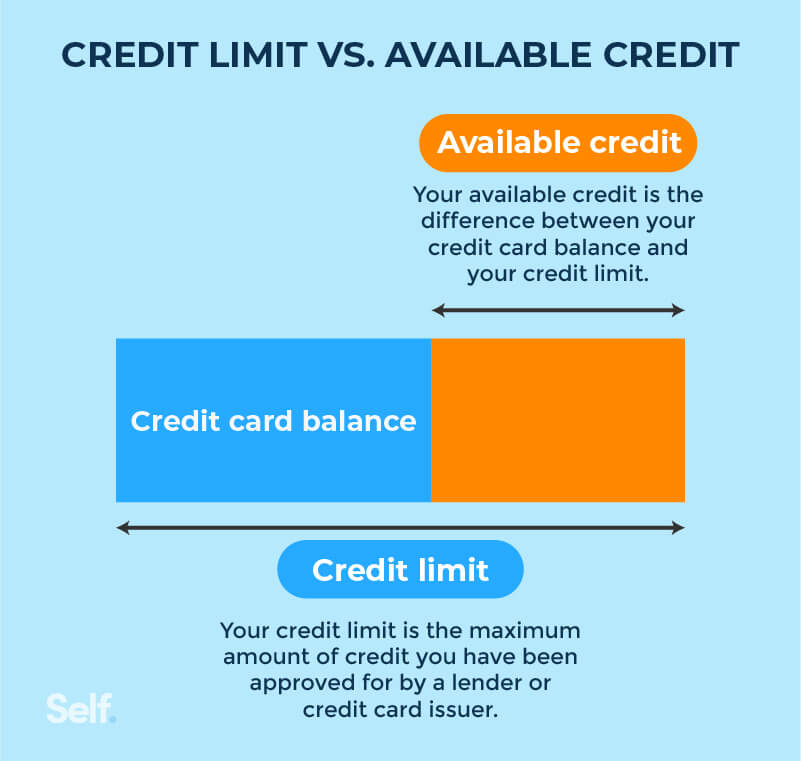

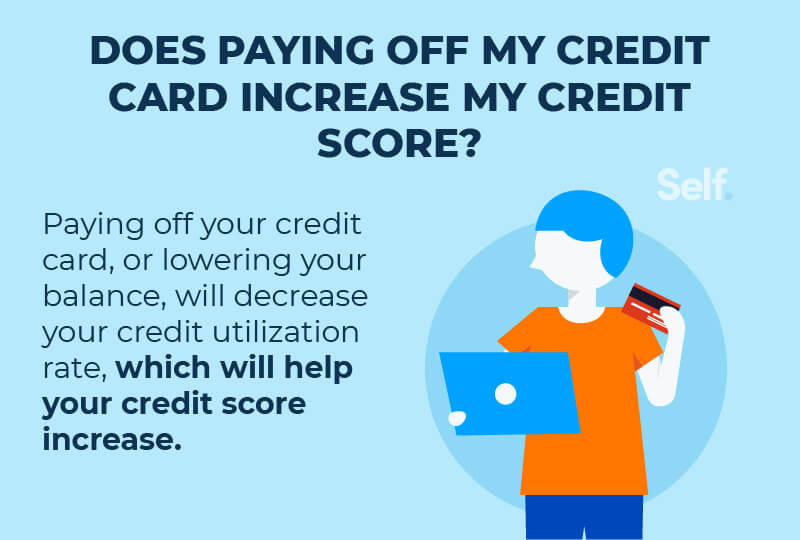

Waive or reduce the minimum monthly payment lower your interest rate remove. $5,000 (total credit card balances) ÷ $20,000 (total credit. Try to keep your credit utilization rate — the percentage of your credit limit that you’re using — at 30% or less.

According to credit rating company experian, if you're focused on having excellent credit scores, a credit utilization ratio in the single digits is best. the truth is, the lower your. As low as 3.99% apr. Tied in with the budgeting process, another great way to reduce credit card use is to limit your opportunities to use it.

Over the last six months, the average annual percentage rate (the interest on a card expressed as an. Find competing credit card offers credit card issuers and. According to experian, millennials have an average of 2.5 cards each, while baby boomers average 3.5.

_1.jpg?ext=.jpg)

:max_bytes(150000):strip_icc()/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)