Recommendation Info About How To Lower Your Apr On A Credit Card

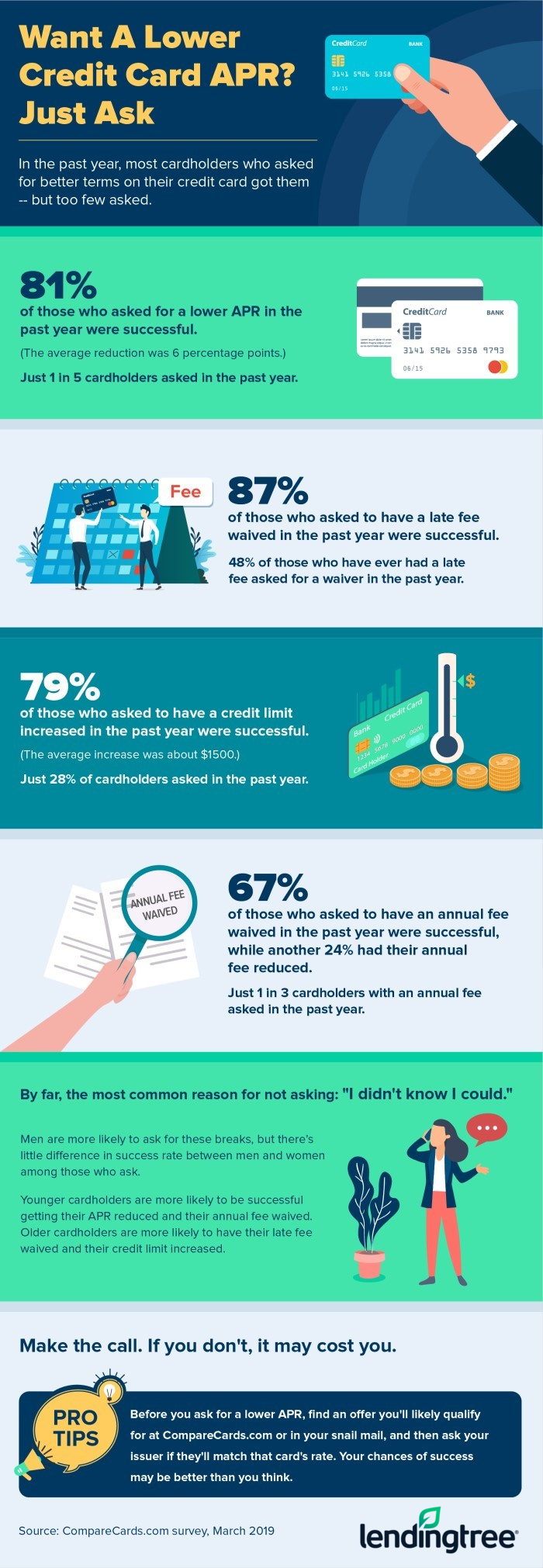

Yes, part of the secret to a lower credit card apr is asking, but the bigger secret is persistence.

How to lower your apr on a credit card. In turn, this can make it easier and faster to pay off. Assess your situation every customer’s circumstances are different. Contact your credit card issuer and explain why you would like an interest rate.

The squeaky wheel really does get the grease. First, assess your own situation and have a goal for. The best way to lower the interest rate on a capital one credit card is to transfer the balance to a 0% apr card from a different credit card company.

A lower interest rate can save consumers money. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a. Typically, issuers will sell unpaid debts to collection.

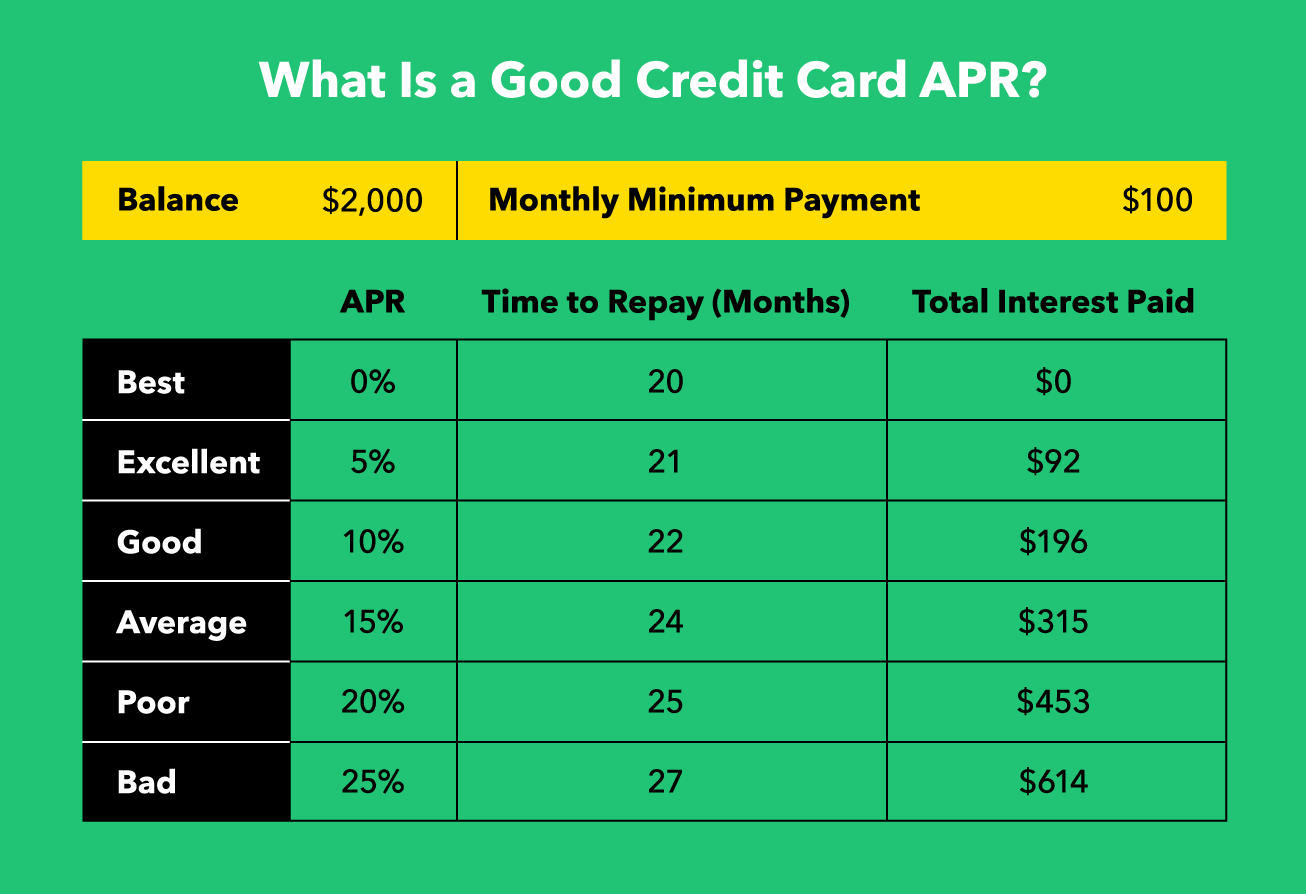

Having a good apr for credit cards is important for a number of reasons. First you divide the annual percentage rate by 365 to come up with a daily rate. Balance transfer as an alternative to a lower rate for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate.

Treat your credit card like a debit card. While interest accrues at 19.99% on your balance, the annual fee further increases your borrowing cost at 22 cents per day ($80 / 365), regardless of how much you charge to your card. First of all, make sure that your payment history with your credit card company has been consistent for at least six.

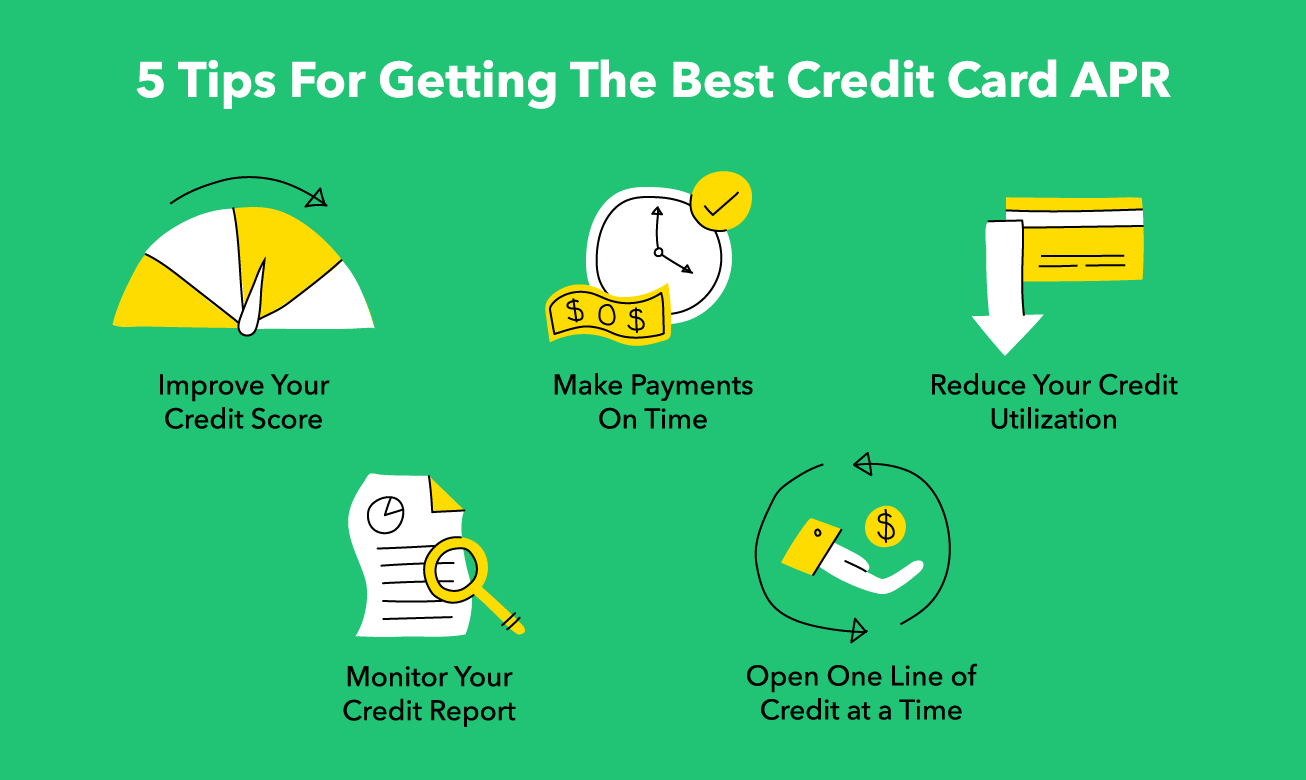

Here's how to negotiate with credit card companies. These cards offer 0% apr introductory offers for a. Improve your credit score an improvement in your credit score is critical if you want to start reducing the apr you're being offered by lenders on credit card applications.